MaxBupa

Advance Reconciliation Solution to empower your accounts team and boosts your financial velocity

Advance Reconciliation Solution to empower your accounts team and boosts your financial velocity

The client’s problem was:

The entire cumbersome manual, time-consuming process was not meeting the business needs and some of the issues that the team was addressing were functional. For eg:

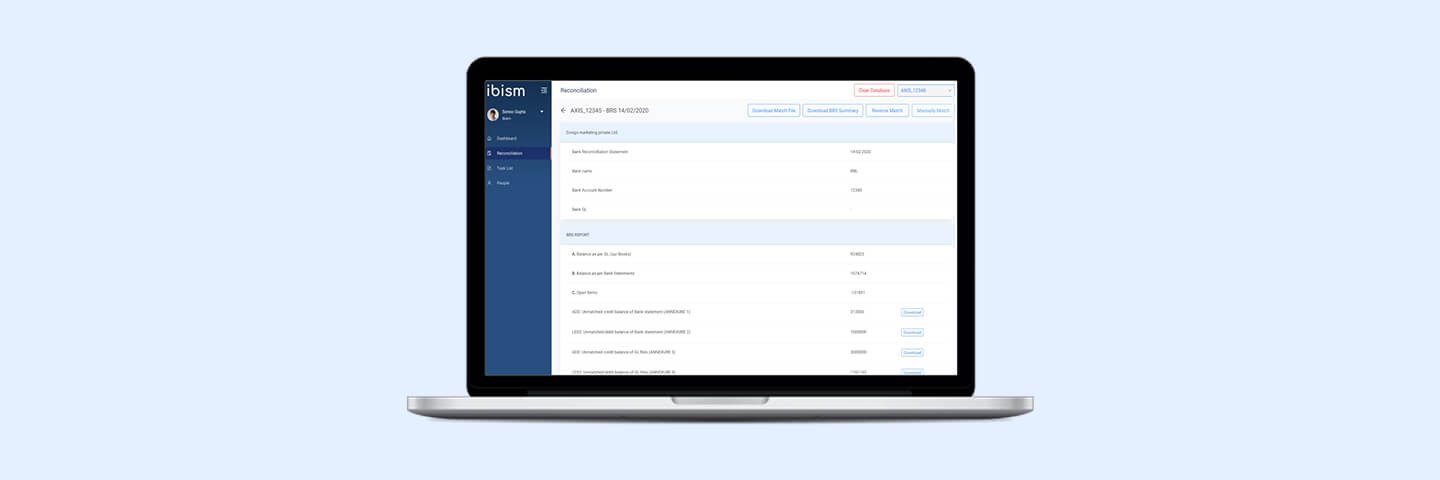

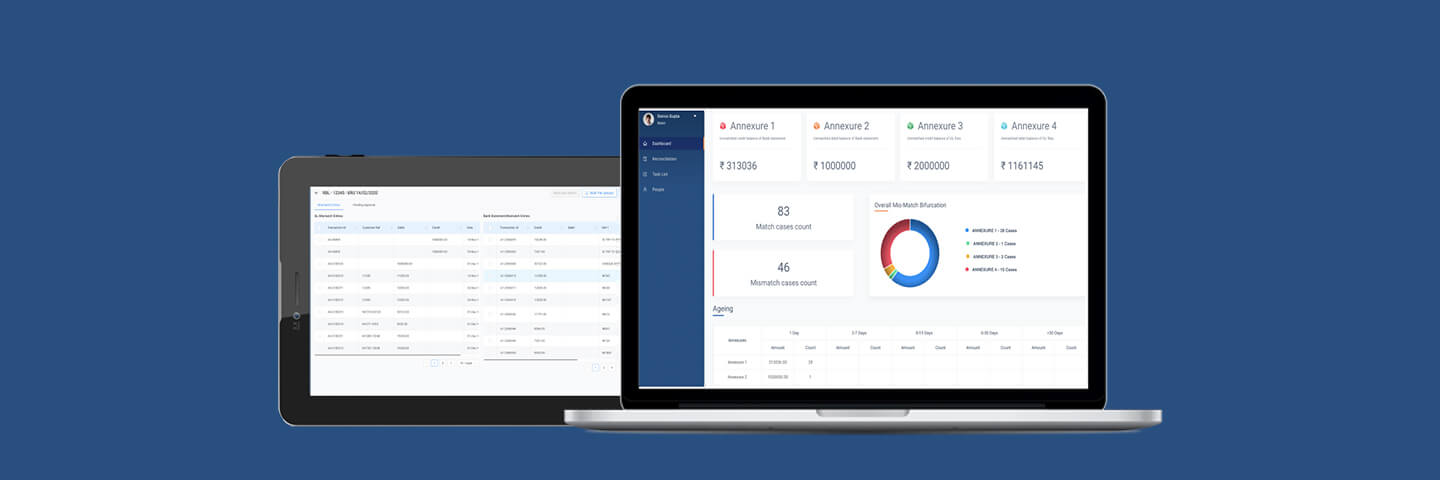

The automated recon solution enables Maxbupa to perform bank reconciliation for complex bank accounts and high volume data with the least manual intervention, accurate precision and high frequency